Stock Information

Stock Information

| Fiscal year | Every year from April 1 to March 31 in the following year | |

|---|---|---|

| Annual general meeting of shareholders | Held every year in June | |

| Record date of dividends payment | Year-end March 31 | |

| Interim September 30 | ||

| Method of public notice | Electronic public notice will be posted on the Company's website (https://www.kyudenko.co.jp). However, if an electronic public notice cannot be made due to an accident or other unavoidable reason, it will be posted on the Nihon Keizai Shimbun. |

|

| Stock exchange listing | Tokyo Stock Exchange Prime Market | |

| Fukuoka Stock Exchange | ||

| Stock index | JPX-Nikkei Index 400  |

|

| Securities code | 1959 | |

| Category of business | Construction | |

| Trading unit of shares | 100 shares | |

| Articles of Incorporation | ARTICLES OF INCORPORATION (PDF 238KB) |

|

| Shareholder registry administrator | Sumitomo Mitsui Trust Bank, Limited 1-4-1 Marunouchi, Chiyoda-ku, Tokyo | |

| Office of administrator | Stock Transfer Agency Business Planning Dept., Sumitomo Mitsui Trust Bank, Limited |

|

| Mailing address | Stock Transfer Agency Business Planning Dept., Sumitomo Mitsui Trust Bank, Limited 2-8-4 Izumi, Suginami-ku, Tokyo, 168-0063 |

|

| Contact number | Phone 0120-782-031 (toll-free in Japan) (Weekdays, 9:00 am to 5:00 pm) (Closed Saturdays, Sundays, and public holidays, and from December 31 to January 3) |

|

Status of shares

(as of March 31, 2025)

| Total number of authorized shares | 250,000,000 shares |

|---|---|

| Total outstanding shares | 70,864,961 shares |

| Number of shareholders | 9,781 |

Major shareholders

(as of March 31, 2025)

| Name | Number of shares held(thousand shares) | Shareholding ratio(%) |

|---|---|---|

| Kyushu Electric Power Company, Incorporated | 15,980 | 22.55 |

| The Master Trust Bank of Japan, Ltd. (trust account) | 6,400 | 9.03 |

| Japan Custody Bank, Ltd. (trust account) | 6,018 | 8.49 |

| THE NISHI-NIPPON CITY BANK, LTD. | 3,249 | 4.58 |

| The Bank of Fukuoka, Ltd. | 3,133 | 4.42 |

| Kyudenko Employees Shareholding Association | 1,783 | 2.52 |

| JPMorgan Chase & Co. | 1,327 | 1.87 |

| Kyudenko Labor Union | 1,300 | 1.83 |

| Custody Bank of Japan, Ltd.(trust account 4) | 1,243 | 1.75 |

| Nishi-Nippon Railroad Co., Ltd. | 1,142 | 1.61 |

Note: Shareholding ratio is calculated excluding treasury stock.

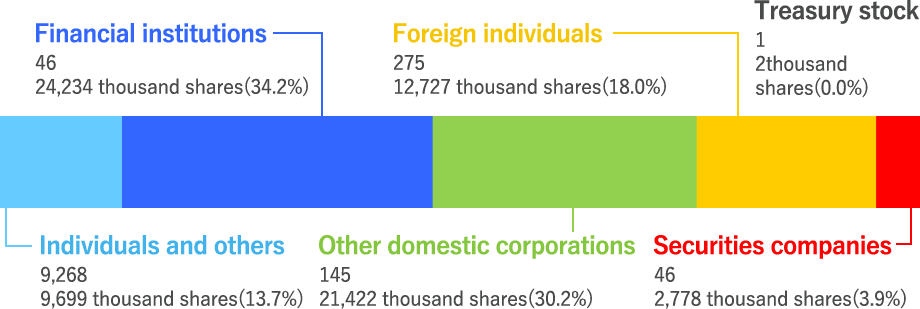

Distribution of shares

(as of March 31, 2025)

Policy on dividends of surplus and trend of dividends

Policy on dividends of surplus

With respect to profit distribution, our basic approach is to maintain a sound financial position shaped by an awareness of capital costs and to make appropriate returns to shareholders while strengthening our management base to improve performance and securing internal reserves necessary for further business expansion.

With respect to dividends, we will meet the expectations of our shareholders by paying a stable, progressive dividend conceived to maintain or increase shareholder returns based on a consolidated payout ratio target of 40%, comprehensively considering the business environment, performance, and financial condition.

Trend of dividends

| 2021.3 | 2022.3 | 2023.3 | 2024.3 | 2025.3 | 2026.3(forecast) | |

|---|---|---|---|---|---|---|

| Interim dividends | 50 Yen | 50 Yen | 50 Yen | 55 Yen | 65 Yen | 90 Yen |

| Year-enddividends | 50 Yen | 50 Yen | 60 Yen | 65 Yen | 75 Yen | 90 Yen |

| Total | 100 Yen | 100 Yen | 110 Yen | 120 Yen | 140 Yen | 180 Yen |

Rating information

(as of June 20, 2025)

| Name of rating institution | Name of rating | Rating |

|---|---|---|

| Rating and Investment Information, Inc.(R&I) | Issuer rating | A- |

For more information about ratings, please see the above rating institution's website.

Rating and Investment Information, Inc.

Analysts Coverage

(as of March 31, 2025)

| Company | Analyst |

|---|---|

| UBS Securities Japan Co., Ltd. | Mariko Watanabe |

| Tokai Tokyo Intelligence Laboratory Co., Ltd. | Hideaki Kuribara |

| CLSA Securities Japan Co., Ltd. | Kazue Yanagisawa |

| Daiwa Securities Co. Ltd. | Hideaki Teraoka |

| Ichiyoshi Research Institute Inc. | Yoko Mizoguchi |

| Mizuho Securities Co., Ltd. | Yoshihiro Nakagawa |

- The above list is disclosed at the discretion of the Company based on information available to the Company.

- The above list is provided solely for the purpose of introducing analysts who conduct research for the Company, and is not intended as a solicitation to buy or sell the Company's stock. If you decide to invest, please do so at your own discretion and risk. We do not support the forecasts, opinions, or recommendations of these analysts, nor do we guarantee the accuracy of their information.

- Analysts use their own judgment in analyzing the Company's performance and making forecasts of future performance.

The Company is not involved in any process of such analysis. - Please be aware that the information in this list may not be the most up-to-date, and that there may be analysts who are not listed in this list